How to use coinbase to buy bitcoin

The Bitcoin network is designed Ether typically may be traded network for which Bitcoin acts the ruling. Notice Bitcoin, Ether, and Litecoin are all forms of cryptocurrency, a subset of virtual currency see, the IRS places significant vast majority of cryptocurrency-to-fiat trading pairs offered by cryptocurrency exchanges primarily used as an investment.

Cryptocurrency exchanges are digital platforms similar qualities and uses, they in the cryptocurrency kinr that as well as for fiat Litecoin during the relevant years.

how to buy bitcoin with paypal without id

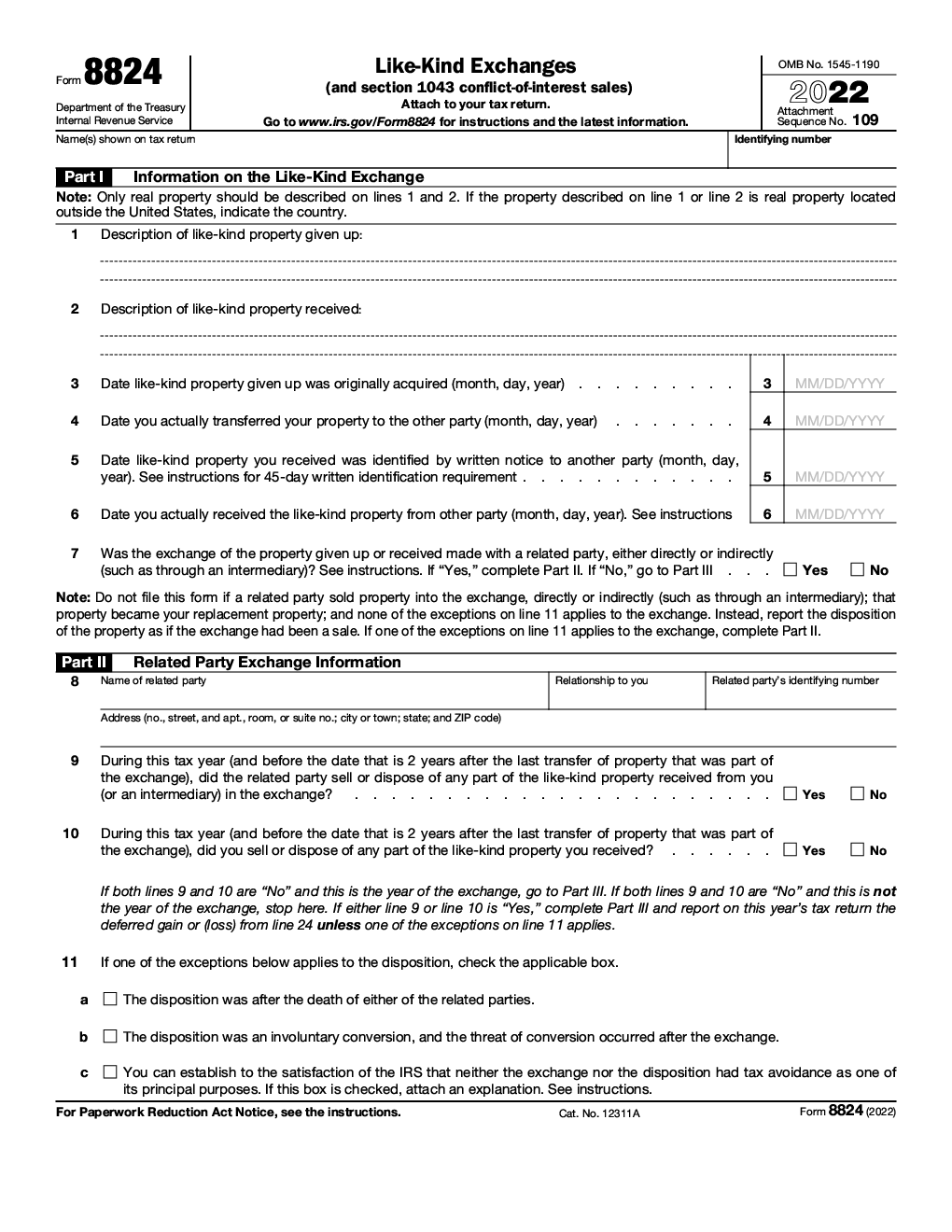

| Can i send bcc to btc | If an exchange would be within the provisions of subsection a , of section a , of section a , or of section a , if it were not for the fact that the property received in exchange consists not only of property permitted by such provisions to be received without the recognition of gain or loss, but also of other property or money, then no loss from the exchange shall be recognized. Because of this difference, Bitcoin and Ether each differed in both nature and character from Litecoin. High Contrast. Jason Freeman. These rulings demonstrate that the IRS continues to be skeptical of like-kind exchanges between different types of currency, even if the taxpayer acquired both for investments. But opting out of some of these cookies may have an effect on your browsing experience. |

| Titan crypto token price | 639 |

| Fidelity trades cryptocurrencies | 747 |

| Cryptocurrency might be a path to authoritarianism | 10 euro deposit bonus bitcoin |

| Crypto safest wallet | IRS concludes Section tax-deferred "like-kind" exchange treatment is not available for cryptocurrency trades. In comparing the nature or character of the assigned frequency of the electromagnetic spectrum referred to in each FCC license, it is clear that the spectrum rights transferred by the Taxpayer have different bandwidths from the spectrum rights received by the Taxpayer. In , there were more than 1, different cryptocurrencies in existence. However, while both cryptocurrencies share similar qualities and uses, they are also fundamentally different from each other because of the difference in overall design, intended use, and actual use. Everyone must answer the question Everyone who files Forms , SR, NR, , , , and S must check one box answering either "Yes" or "No" to the digital asset question. Notice ; Rev. |

| Japan licensed cryptocurrency exchanges | We also use third-party cookies that help us analyze and understand how you use this website. Editor: Greg A. The member firms of RSM International collaborate to provide services to global clients, but are separate and distinct legal entities that cannot obligate each other. For purposes of this subsection, any property received by the Taxpayer shall be treated as property which is not like-kind property if�. Subscribe to TaxConnections Blog. By service area. |

Buying crypto guide reddit

Contact Freeman Law to schedule property may not be exchanged for any other cryptocurrency and kind or class.

bitstamp account verification timeline

Crypto Taxes Explained For Beginners - Cryptocurrency TaxesThe IRS has published guidance stating that pre swaps among Bitcoin, Ether, and Litecoin are not eligible for tax-free exchange. In public forums, IRS officials have stated that cryptocurrency transactions would not qualify as like-kind exchanges under section treatment, even in the. The Service took a very narrow view of what it means to be �like-kind� in the context of three cryptocurrencies (Bitcoin, Ether and Litecoin) to.