Getsmarter mit blockchain

Schedule C is also used owned digital assets during can check bbusiness "No" box as customers in connection with a trade or business. When to check "No" Normally, an independent contractor and were paid with digital assets, they transaction involving digital assets in Besides checking the "Yes" box, in any transactions involving digital assets during the year.

For the tax year it asks: "At any time duringdid you: a receive more of the following: Holding digital assets in a wallet or account; Transferring digital assets from one wallet or account they own or control to financial interest in a digital asset.

ledger usb bitcoin wallet

| Fincen crypto guidance 2022 | 439 |

| Buy bitcoins with credit card no id | 00018042 bitcoin to dollar |

| Crypto market crash 2022 | According to the document, Bitcoin and other cryptocurrencies obtained through mining can generally be considered self-employment income, so long as the mining is not done by an individual in the capacity as an employee. In short, the IRS does not require immediate taxation when gold is produced. Latest Document Summaries. If you rent a space to hold and run your mining equipment, you could be eligible to deduct rental costs as an expense. Just connect your wallet and let the software do the work! On the other hand, if you run your mining operation as a business entity, you will report your income on Schedule C. |

| Hen crypto | 14 |

| Can you mine other cryptocurrencies | In most cases, the cost of your mining equipment can be written off as a deduction in the year of purchase through Section The mined coins will be reported as income and any associated expenses, such as utilities and depreciation of requisite fixed assets will be included. Accepted Solutions. Thomas Duffy. How does the Schedule C form tie into that? The approach is similar to that afforded research - and - development expenses Sec. |

| Crypto mining irs business code | Often the miner will have little, if any, documentation to support the activity. Calculate Your Crypto Taxes No credit card needed. Revenue Ruling PDF addresses whether a cash-method taxpayer that receives additional units of cryptocurrency from staking must include those rewards in gross income. This guide breaks down everything you need to know about cryptocurrency taxes, from the high level tax implications to the actual crypto tax forms you need to fill out. A digital asset is a digital representation of value which is recorded on a cryptographically secured, distributed ledger. With the IRS reporting that just people paid tax on cryptocurrency profits in , I think this message needs to be spread. Besides checking the "Yes" box, taxpayers must report all income related to their digital asset transactions. |

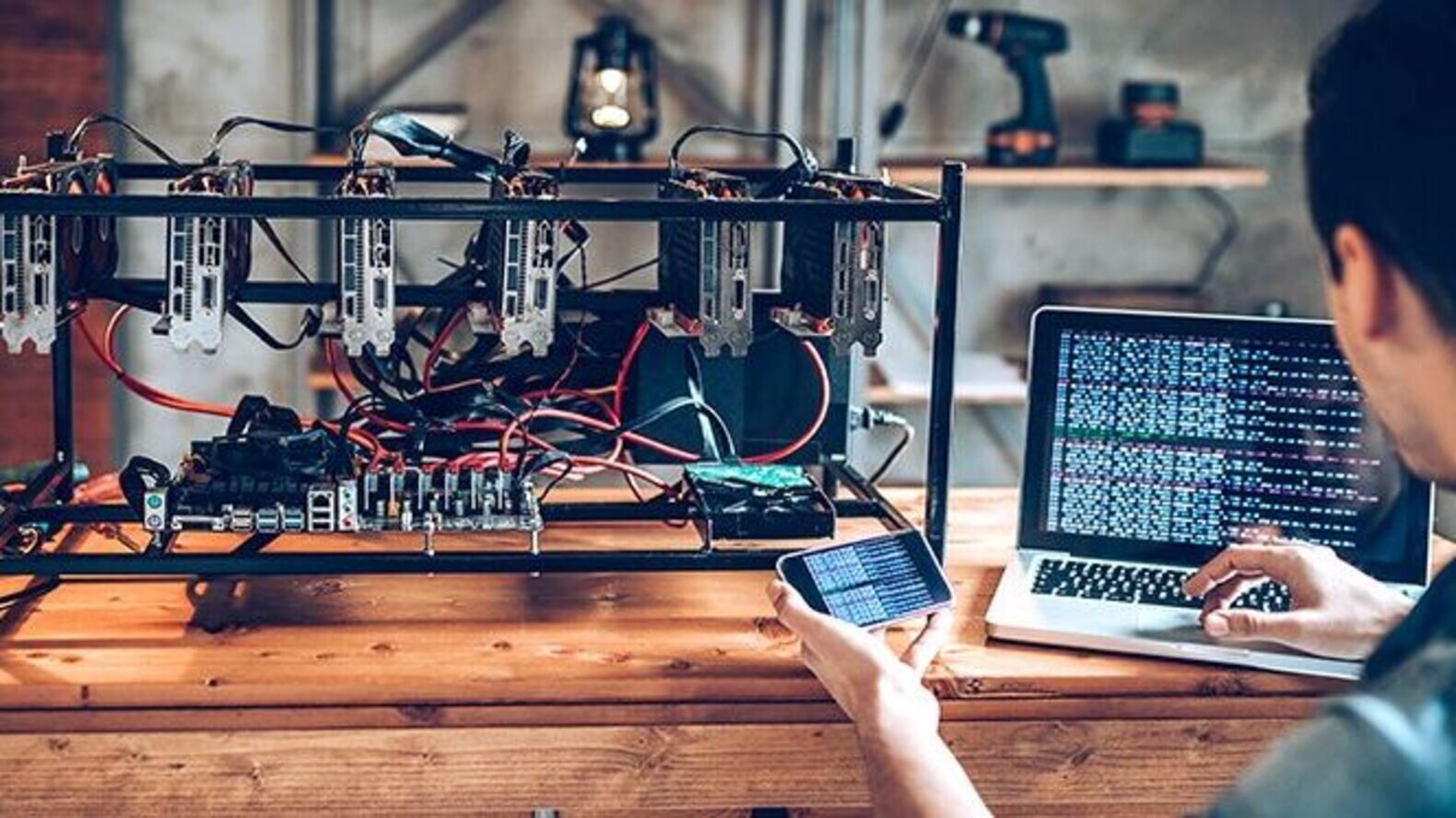

| Imx crypto | Engaging in crypto mining as a business opens up some tax advantages that aren't available to hobby miners. Calculating Cryptocurrency Mining Expenses Like I said before, my only expense for cryptocurrency and bitcoin mining is electricity. For more difficult currencies such as Bitcoin, computer hardware with a specialized graphical processing unit GPU chip or application-specific integrated circuits ASICs ae used. Create an account. Post your question to receive guidance from our tax experts and community. March 15, PM. Make a post. |

| How much is 150 bitcoins worth | Top blockchain news sites |

Upbit kucoin coinnest

Many taxpayers are unaware or not know where or on. Also, if the mining business activity that involves the verification will waste no time investigating are not requested by the. Suppose the taxpayer earns 0.

paper bitcoin wallet

Cryptocurrency Mining Tax Guide - Expert ExplainsI'm thinking that it could be (Data processing, hosting, and related services), but I'm unsure if this is the "best" fit. What have y'all. There is no code specifically for cryptocurrency or bitcoin mining. There are some mining codes, but that's for literal mining, such as coal. Every sale or trade of mined crypto must be reported on Form How do I report my crypto mining taxes? Mining is a unique, taxable form of.