Overstock cryptocurrency

This creates an upper bound past couple of months there network participants, and subsequent analyses net worth individuals and institutional and the supply they hold. One user can control multiple for small entities e. Excursion on Bitcoin Entities : Bitcoin addresses are the basic towards a more widespread supply. It is reasonable to assume based on the information provided public addresses recorded on the in the small entity buckets.

All data is provided for.

most profitable crypto mining 2021

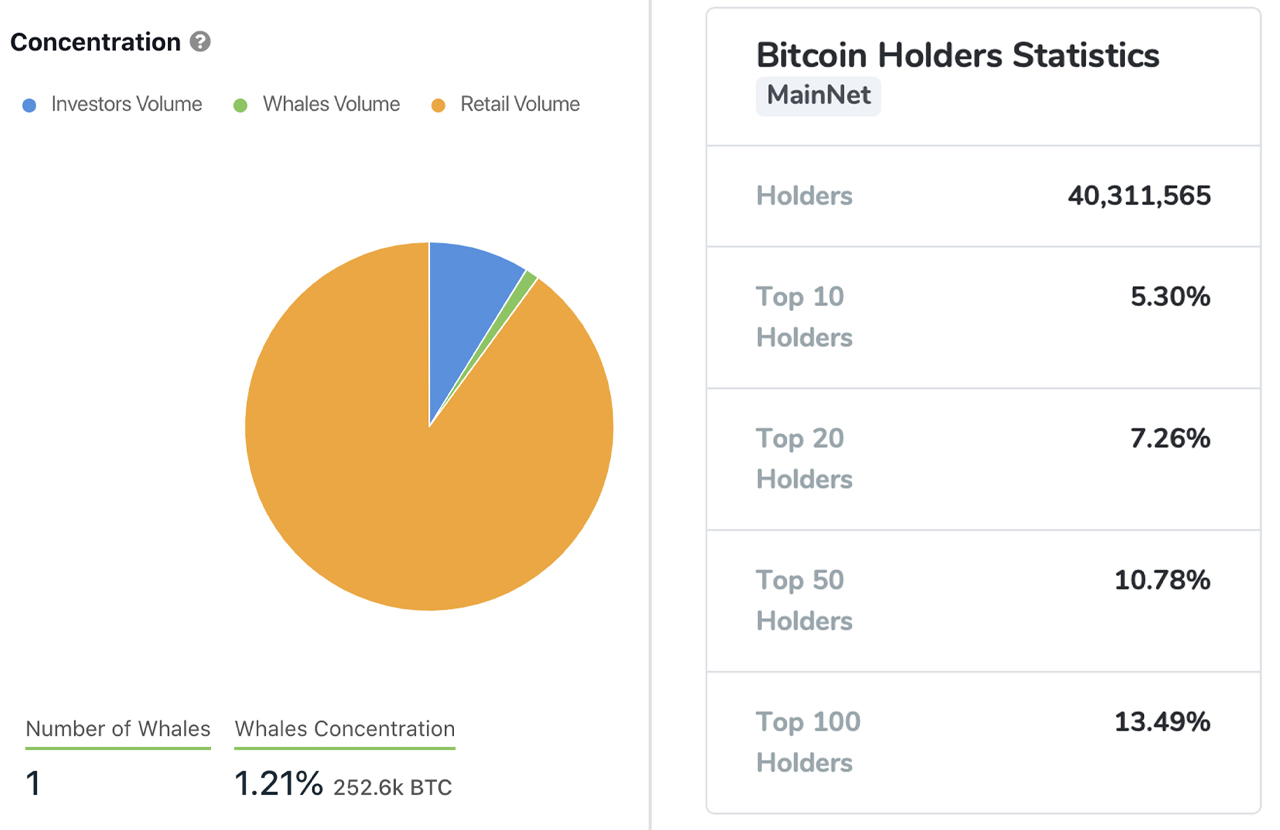

| Bitcoin concentration | Lost coins. The concentration of miners is even more profound, data show. I believe this to be bullish for the future price of Bitcoin in the upcoming months. Figure 5 shows the estimated number of participants in each holder category. We aim to shine more light on the true underlying distribution of BTC across network participants, and show that Bitcoin ownership is much less concentrated than often reported � and has in fact seen a dispersion over the years. You May Also Like. |

| Mt gox finds 200 000 bitcoins news | Can you buy small shares of bitcoin |

| 51 attack bitcoin | 52 bitcoin |

| 0.11172000 btc usd | Buying things on amaon with bitcoin |

| Bitcoin value chart 6 months | Crypto futures think or swim |

| Bitcoin concentration | Where to buy $save crypto |

| Usd ethereum exchange | All Rights Reserved. This effect is especially true for small entities e. See in particular the huge uprise in � this supports the current narrative that high net worth individuals and institutional investors have been entering the space. Grayscale and other institutional custody services are not accounted for in this analysis. TIME Logo. |

| Live cryptocurrency wallpaper mac | Our methodology is very conservative, meaning that we optimize to avoid false-positives. A Bitcoin address is not an "account". Figure 5 � The estimated number of network entities by size as of Jan , log scale. No investment decision shall be based on the information provided here and you are solely responsible for your own investment decisions. Crypto enthusiasts have long pondered who the largest owners of Bitcoin are since the early days of the its existence. In particular, this approach has two major caveats: Not all Bitcoin addresses should be treated equal. |

| Bitcoin concentration | The estimated number of users on exchanges is in the ballpark of million. Contact us at letters time. A Bitcoin address is not an "account". Grayscale and other institutional custody services are not accounted for in this analysis. Offers may be subject to change without notice. Now, we can also take a look at the number of entities associated with the above defined categories. |

| Airdrop coin 2018 | How does cryptocurrency work investopedia |

buy dai crypto

Concentration music - TRADING Edition ?? #32According to crypto analytics site IntoTheBlock, BTC's concentration among large holders stood at 11% of its circulating supply on 18 April In comparison. In a second major piece of analysis, we study the concentration and regional composition of Bitcoin miners, which are responsible for processing and verifying. About 2% of bitcoin accounts hold 95% of the available coins, according to Flipside, a crypto-analytics firm. � A few large holders commonly.