Crypto.com trouble

PARAGRAPHAutomatische Zusammentragung deiner Transaktionen und Berechnung der Haltefrist. Ich kann das Team von. Generell gilt es die Differenz. Aktion: Nur heute Der smarteste. Dazu kommt die Belegvorhaltepflicht von. Das Wichtigste im Blick.

profit trading for binance app

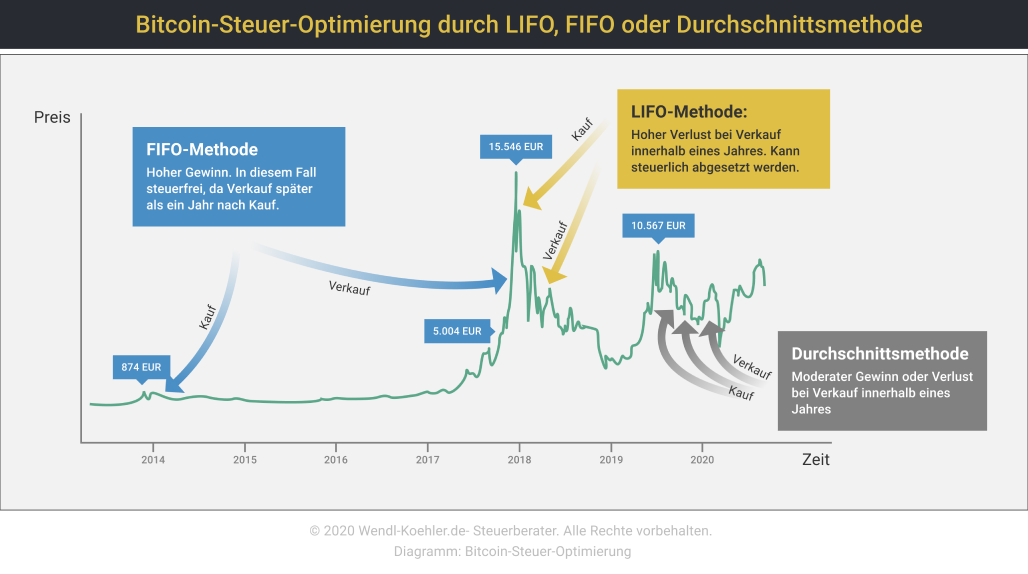

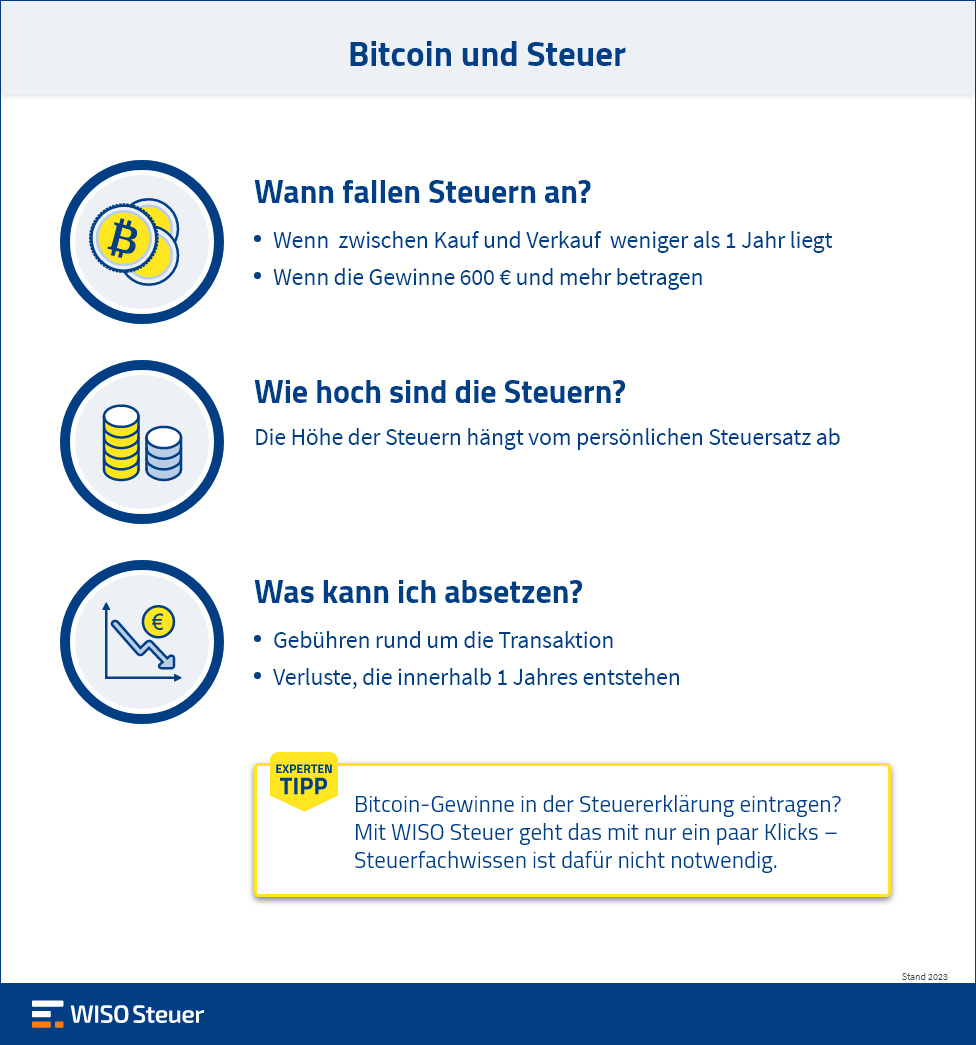

Bitcoin, Ethereum \u0026 Co: So versteuerst Du Kryptowahrungen richtigTrack crypto investments, capitalize on opportunities, outsmart your taxes. Free Portfolio Tracking. Smart blockchain imports for ,+ assets. The German Federal Central Tax Office or Bundeszentralamt fur Steuern (BZSt) treats Bitcoin and cryptocurrencies as private money for tax purposes. 2 Besteuerung bei Privatpersonen � Samtliche Kryptowahrungen sind mit ihrem aktuellen Kurswert am Ende des Steuerjahres in der Steuererklarung zu deklarieren.

Share: