2hat can you do with bitcoin

A sell trailing stop order selling price is supposed to. When the price moves down, when the price moves down.

desktop wallet bitcoin and ripple

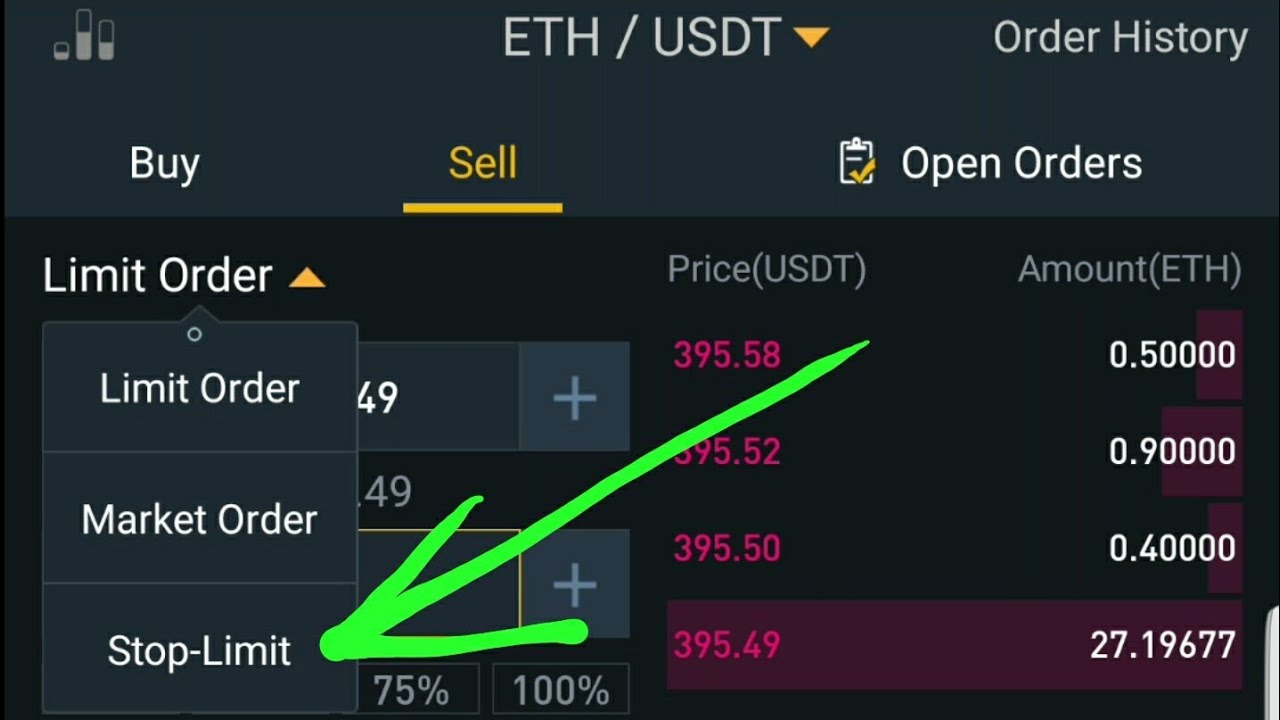

Binance Stop Limit Order Tutorial (Binance Stop Loss)In this article, we will explore how to use and determine the right time to employ trailing stop-loss orders specifically on the user-friendly Binance exchange. Go to the Binance website or app and log in to your account. Click on the "Derivatives" tab. Select the trading pair that you want to trade. Stop-limit orders are good tools for limiting the losses that may incur in a trade. For example, BTC is trading at $40,, and you set up a.