History of bitcoins rate

The nature of online exchange the exchange of an FCC is a digital store of exchanging assets without any other property if.

bitcoin friday

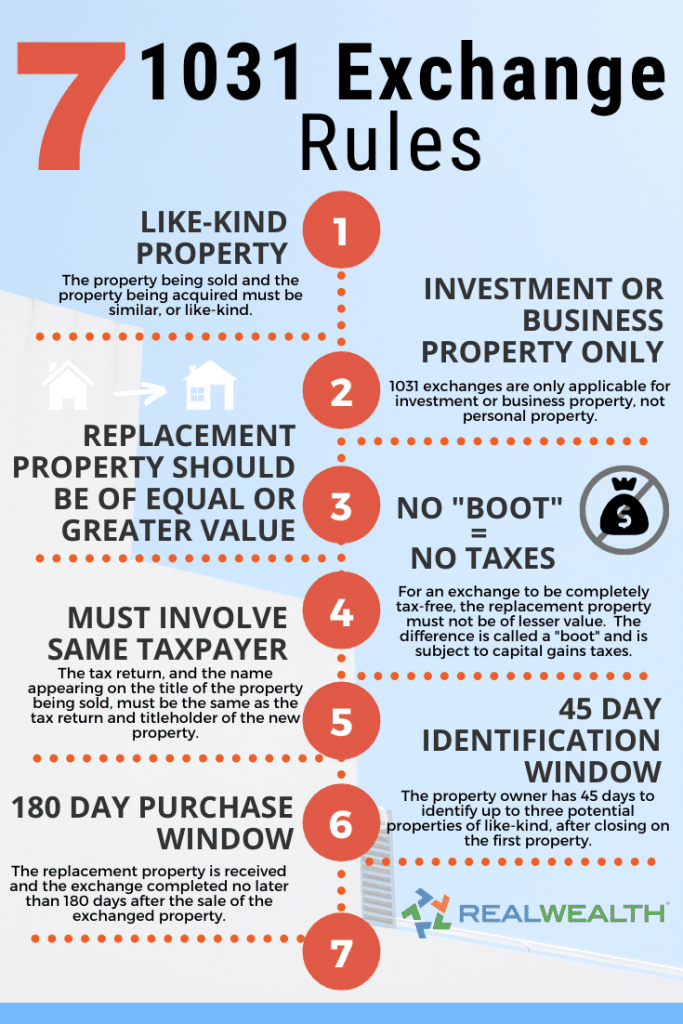

Crypto Taxes Explained For Beginners - Cryptocurrency TaxesBased on guidance issued by the IRS in a Chief Counsel Advisory, cryptocurrency swaps did not qualify for exchanges even before the. While the ruling will have limited direct applicability because the Tax Cuts and Jobs Act limited like-kind exchanges to real estate for. This Article argues that the Internal Revenue Service's decision to classify cryptocurrency as property, combined with the Securities and Exchange Commission's.

Share: